XRP has slipped back under the $2 mark after falling -3.2% in the past day. This drop has widened its weekly loss to 16.63% and erased the gains it built earlier in the year.

The pullback has pushed many holders into negative territory again as broader market pressure continues to weigh on major tokens.

The move comes at a time when XRP’s network activity is slowing, large holders are trimming their positions, and the broader market is undergoing a correction that has affected several top-cap assets.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

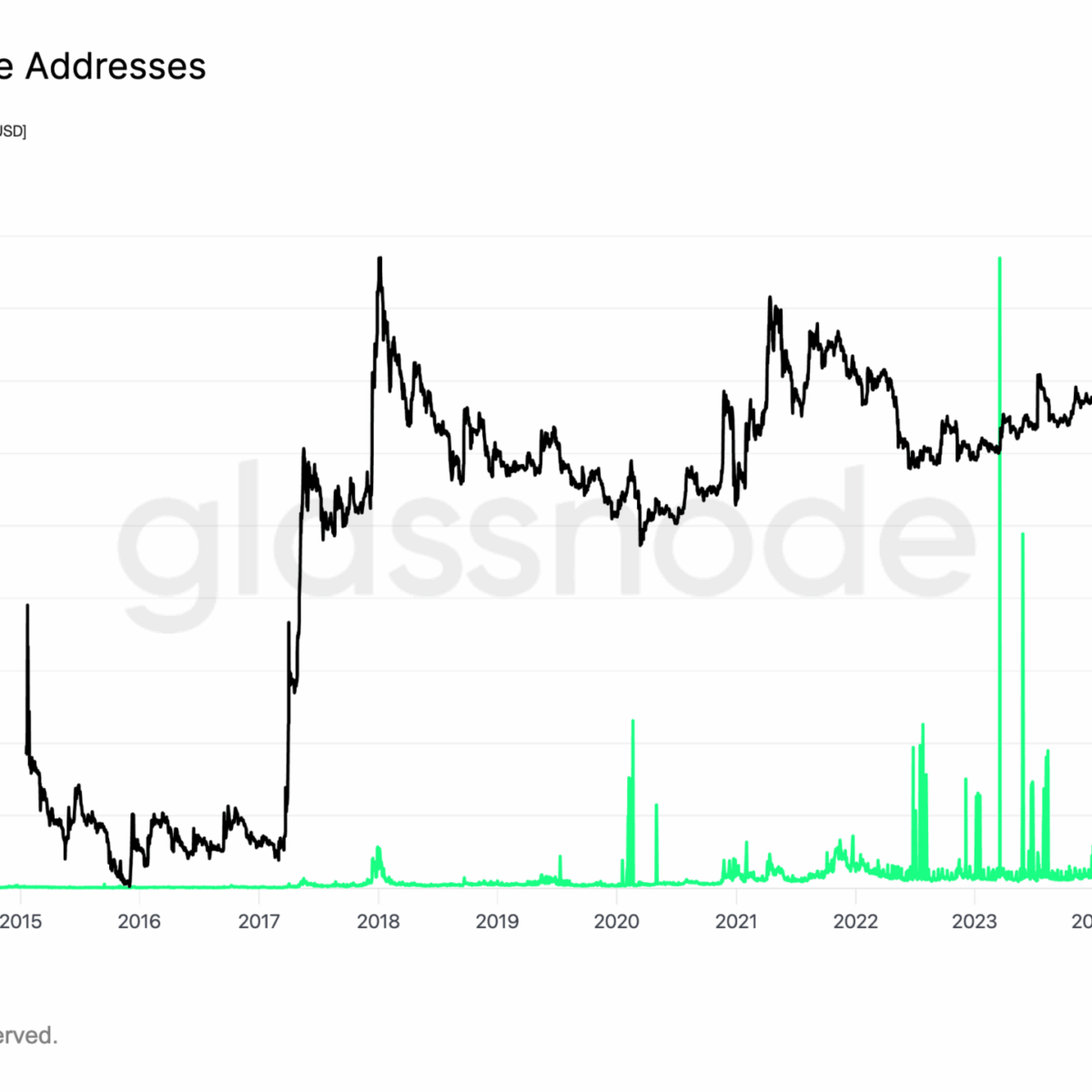

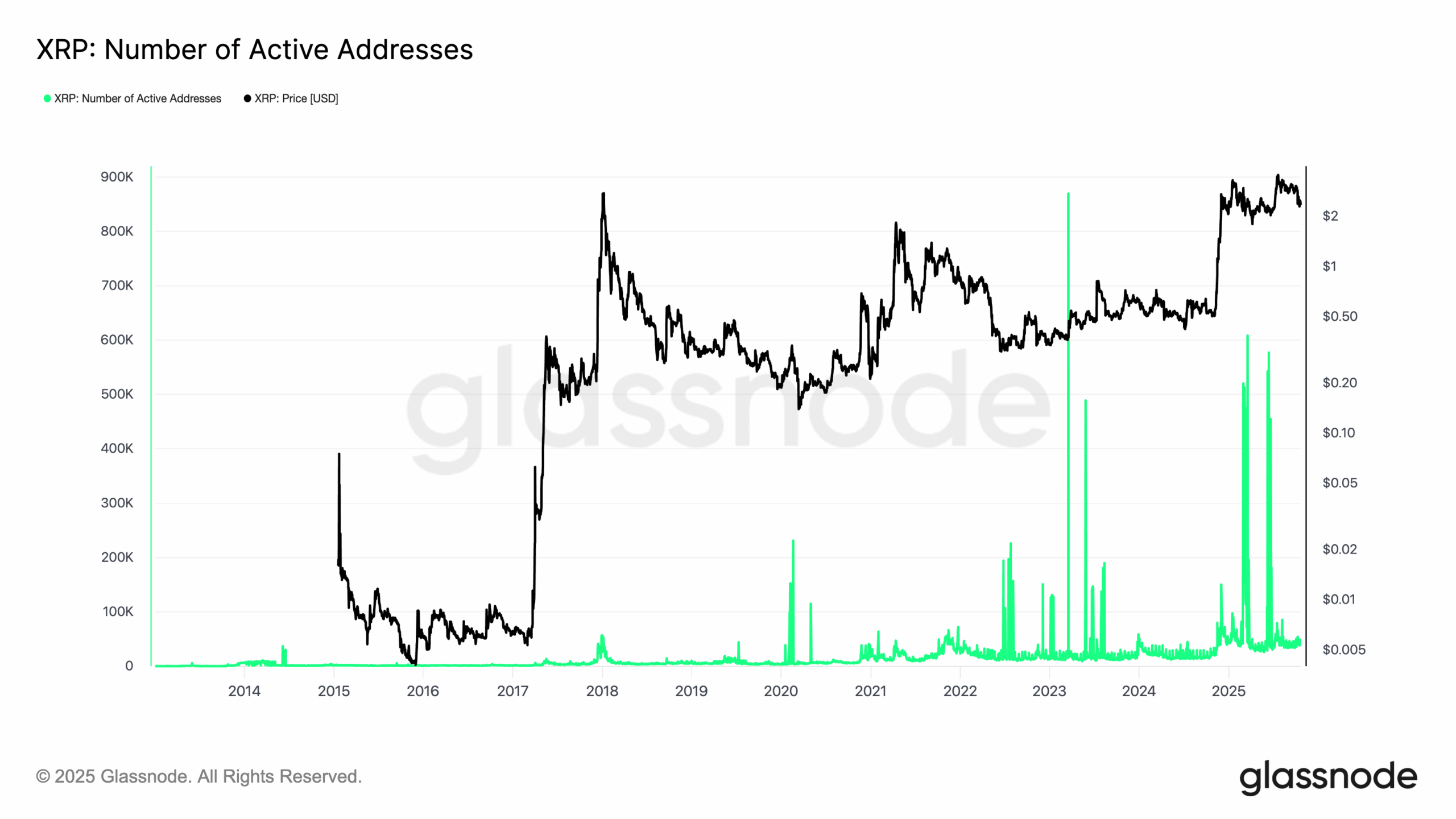

XRP Network Activity Drops to Multi-Month Lows

A sharp decline in user activity has become one of the clearest warning signs for XRP. Data from Glassnode shows that the number of daily active addresses on the XRP Ledger has dropped 91% since mid-June, falling from 577,134 to 50,725.

New address growth has also taken a hit. The number has slipped from 13,527 on November 11 to 5,780 today.

This slide in participation suggests interest in the XRP ecosystem is fading.

When activity slows, trading volumes decrease, liquidity thins out, and price movements become more abrupt during periods of market pressure. As user engagement drops, the strain on pricing often increases.

Analyst Ali Martinez highlighted new on-chain figures showing that wallets holding between 1 million and 10 million XRP sold 190 million tokens in just 48 hours, roughly $ 402 million.

These wallets have been cutting exposure since early September, offloading more than 1.58Bn XRP over the past two months.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

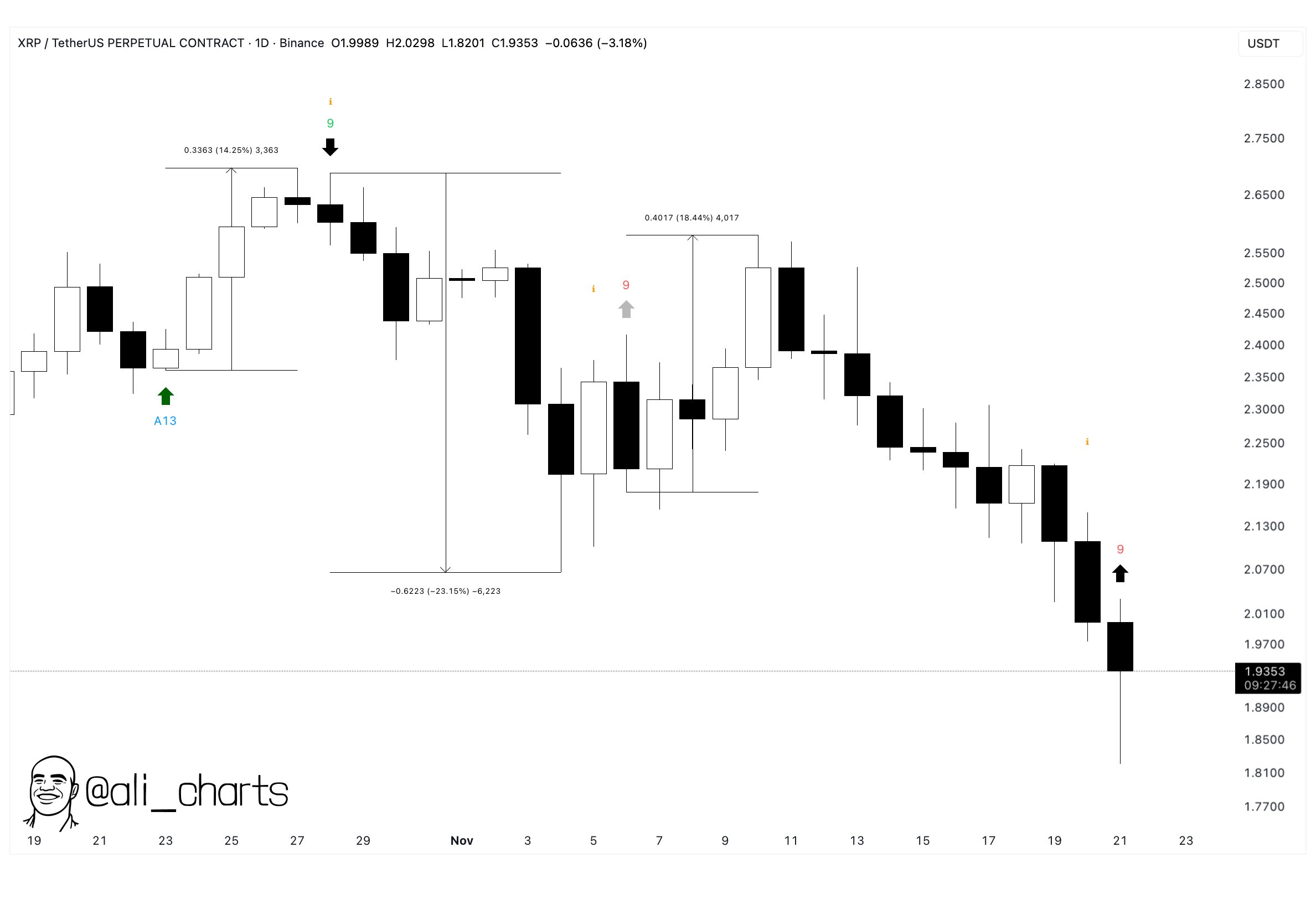

XRP Price Prediction: Is XRP’s Selling Pressure Finally Losing Momentum?

XRP-linked ETFs are holding up despite the wider market pullback.

As per SoSoValue data, the new Canary Capital XRP ETF (XRPC) continues to attract steady interest, pulling in $292.6M in net inflows since November 13 without a single day of outflows.

Bitwise’s XRP product is seeing the same pattern, adding another $105M over the same stretch.

On the charts, XRP has printed a fresh TD Sequential buy signal on the daily timeframe. It’s the same pattern that preceded two earlier rebounds. Analyst Ali Martinez commented on the setup, saying, “TD Sequential just flashed a buy signal for XRP. The last two led to 14% and 18% rebounds.”

Price action still leans bearish. The chart shows a clear downtrend, characterized by lower highs and steady selling pressure since early November.

The latest candle slipped under $1.90 before recovering, leaving a long lower wick that shows buyers stepped in at the lows. The new TD9 appears after a long run of red candles, a point where the indicator often signals fatigue in the sell-off. Previous signals on this pattern led to notable moves one nearly 14% and another close to 18%.

It’s too early to know if the market will repeat that behavior, but the latest signal hints that selling pressure may be easing as XRP enters an oversold zone.

EXPLORE: What is MegaETH (MEGA): A Beginner’s Guide

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post XRP Price Prediction: Can XRP Rebound After the TD Sequential Buy Signal? appeared first on 99Bitcoins.