- XRP price has held firm above $1.90 for over eight months, signalling strong market support amid a possible breakout.

- Ripple’s push for a banking charter and speculation in ETFs has boosted investor confidence in XRP’s long-term potential.

XRP continues to draw investor attention as it maintains a steady position above its previous local support of $1.90. With the asset consolidating for over eight months and new institutional moves surfacing, market watchers are beginning to anticipate a major breakout.

Experts believe the stage may be set for a significant rally, possibly pushing XRP’s price as high as $30–$50 during the next market cycle.

XRP Maintains Strong Support

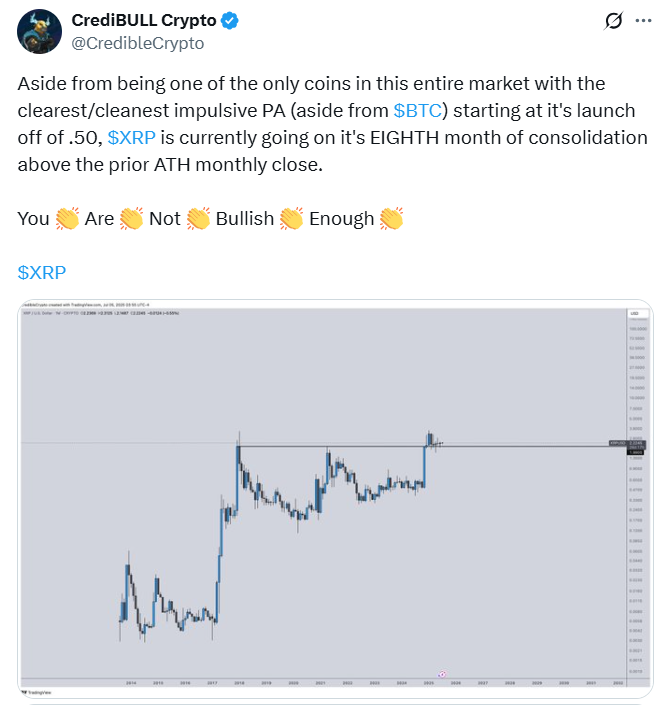

According to reports, XRP price has remained above its previous monthly low of $1.90 for over eight months. This indicates strong support, despite the broader market’s uneven pace. This sustained price level follows a sharp upward move from $0.50 to $3.60.

As of writing, Marketcap data pegged the price of the coin at $2.22, up 0.67% in 24 hours.

It is worth mentioning that since that rally, XRP has been trading within a narrow band. This suggests consolidation rather than decline. Market analysts view this as a potential precursor to the next leg of growth. Technical analyst CrediBULL Crypto views this price movement as part of an Elliott Wave structure.

According to the model, the current sideways range is classified as Wave (ii), following an earlier Wave (i) impulse. If the pattern holds, XRP could be preparing for Wave (iii), often the most aggressive phase in the cycle. This leg could take prices to between $8 and $12. A final rally in Wave (v) is projected to reach around $32, possibly by 2026.

The pattern has attracted attention because XRP, unlike many altcoins, has not faced a deep correction over the same period. This trend, combined with consistent monthly closes above key support, signals strong buyer interest.

Ripple’s Institutional Moves and Legal Progress Spark Confidence

Previously, we covered that Ripple, the company linked to XRP, recently confirmed it has applied for a national banking charter and a Federal Reserve master account. These applications could allow Ripple to offer regulated services such as insured accounts and access to payment rails like FedNow. If granted, this would position Ripple as the first full-scale crypto bank in the United States.

At the same time, the long-standing SEC lawsuit is reaching its conclusion. CNF reported that Ripple has dropped its cross-appeal. This suggests it wants to bring the case to a final close. This has added optimism to XRP’s long-term outlook.

As indicated in our earlier discussion, XRP also processed over 1.6 million transactions in a single day, with a transaction volume exceeding $500 million. This happened amid talk of a possible spot ETF. Software engineer and XRP advocate Vincent Van Code believes a spot XRP ETF could pull in between $20–$50 billion in institutional capital.

He also highlighted Ripple’s link with Saudi Arabia’s central bank as a sign of broader global use for XRP in finance, including potential oil settlement deals. In addition, as highlighted in our previous news brief, market participants believe that the new regulatory clarity and ETF approval could push XRP to $25 this July.

It is worth noting that these recent steps, along with XRP’s steady price action, have led analysts to believe a breakout could push the coin up to 1,500% from current levels. In another major update we noted earlier, Robinhood added XRP and Solana micro futures, lowering cost barriers for retail crypto traders.