Let’s try to answer why the crypto market is down today. Yesterday, the U.S. Producer Price Index (PPI) for July rose 0.9% month-over-month and 3.3% year-over-year, far above forecasts of 0.2% and 2.5%. It was the largest monthly jump since June 2022, fueled by rising service costs in machinery wholesaling, portfolio fees, hospitality, and freight, alongside higher prices for vegetables and meat. The higher-than-expected data renewed inflation concerns, dampening hopes for a Federal Reserve rate cut and prompting traders to reassess the best crypto to buy in a more risk-off environment.

BRUTAL: Producer Price Index (PPI) surges to 3.3% YoY in July, far exceeding expectations. Core PPI up 3.7%. Trump’s tariffs on imports are driving up wholesale costs, signaling even higher prices for consumers.

— MeidasTouch (@MeidasTouch) August 14, 2025

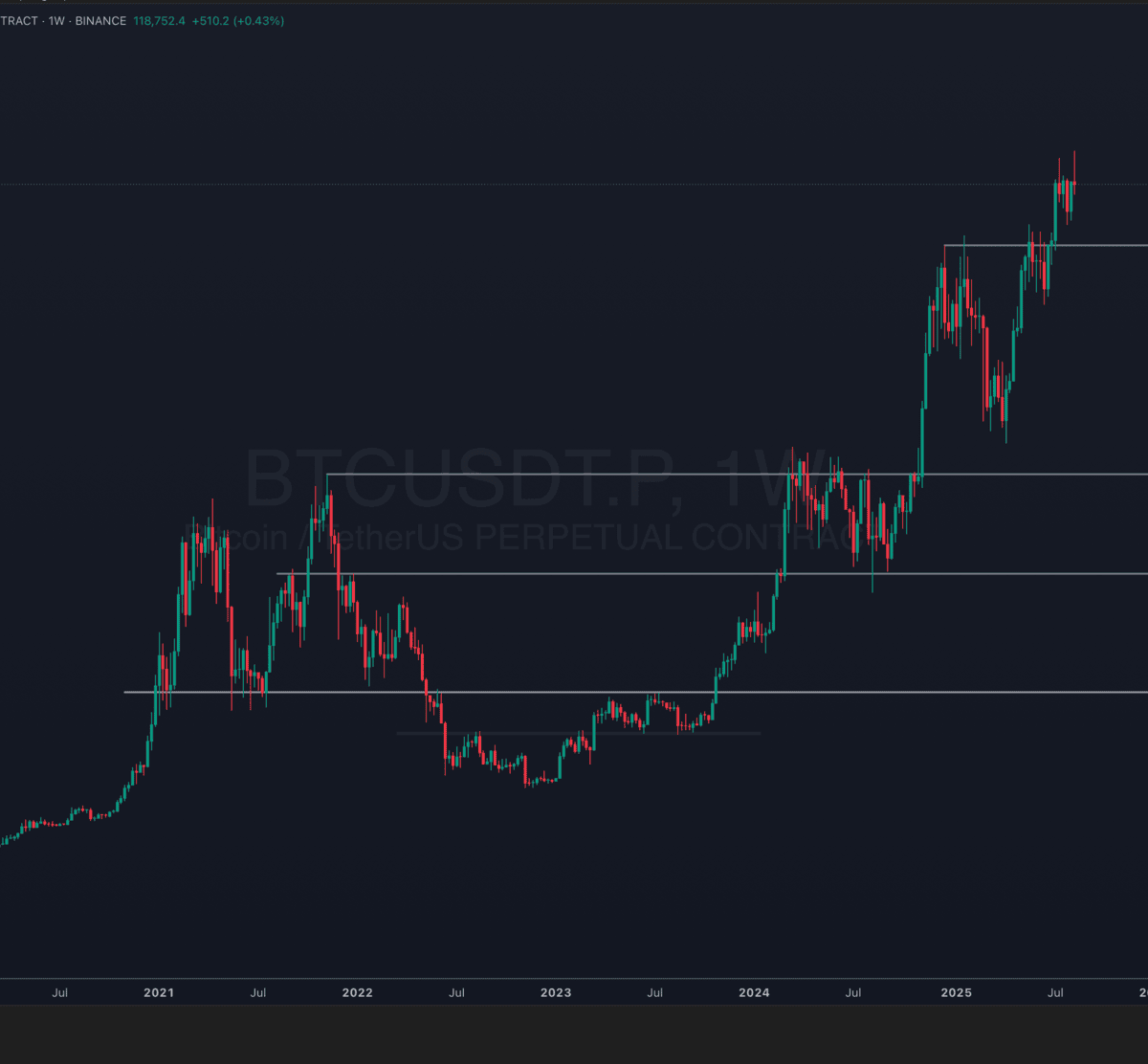

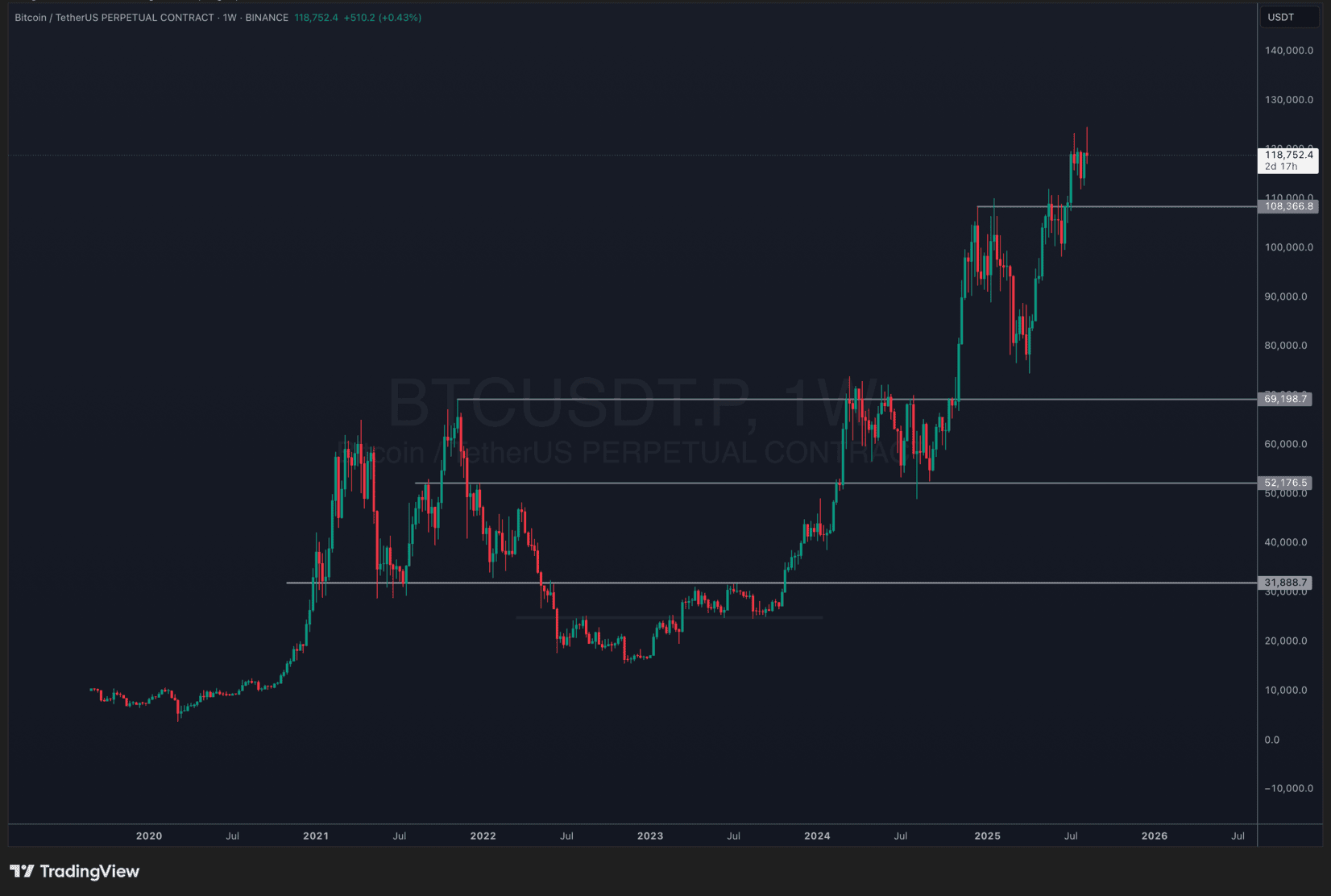

Crypto markets reacted immediately. Bitcoin slid 5.88% to under $117,200, down from recent all-time highs, while Ethereum fell nearly 7%, briefly dipping below $4,500. Meme coins took the heaviest hit: PEPE, SPX6900, and Fartcoin each plunged over 10%, dragging the sector down 8.62% in 24 hours. XRP dropped 6.4% to $3.12. Over $1 billion in long positions were liquidated within an hour.

(BTCUSDT)

At the same time, some projects still pumped. SKALE surged nearly 48%, standing out in an otherwise red market.

EXPLORE: The 12+ Hottest Crypto Presales to Buy Right Now

PPI Outpaces CPI – Should Crypto Investors Worry or Hunt for the Best Crypto to Buy?

CPI reflects consumer prices, while PPI measures production costs. When PPI rises faster than CPI, it pressures profit margins and signals potential inflation: typically bearish for equities. For crypto, the link is weaker. As a high-volatility, risk-on asset class, market drivers such as strong narratives, retail FOMO, and memecoin speculation can outweigh macro headwinds.

In 2021, for example, PPI climbed sharply yet BTC and ETH continued a parabolic rally, supported by liquidity and institutional inflows.

Bitcoin has reclaimed $118K, Ethereum is back above $4.6K, and the market mood leans toward buying yesterday’s dip. So, what are the latest crypto updates for August 15?

Federal Reserve to End Special Crypto and Fintech Oversight Program

The Federal Reserve announced it will suspend its “Novel Activities” supervision program, which monitored banks engaging in crypto and fintech activities. Launched to oversee emerging banking practices not fully covered by traditional rules, the program provided extra guidance and scrutiny for banks exploring digital assets and innovative financial technologies.

With the program ending, banks will no longer receive this specialized oversight, though they remain subject to standard regulatory requirements. The move signals a shift in the Fed’s approach to supervising crypto and fintech, potentially giving banks more flexibility while maintaining core safety and compliance standards.

SharpLink Reports Q2 2025 Results, Now Holds 728,804 ETH

MINNEAPOLIS, Aug. 15, 2025 – SharpLink Gaming reported Q2 2025 results and updates on its ETH treasury strategy. Since adopting Ether as its primary treasury asset in June, SharpLink has raised over $2.6 billion, acquired 728,804 ETH, and staked nearly all holdings, generating 1,326 ETH in rewards. The company also increased its ETH Concentration metric by 98%, reflecting efficient accumulation.

SharpLink strengthened its leadership with Ethereum co-founder Joseph Lubin as Chairman and former BlackRock executive Joseph Chalom as Co-CEO, partnering with Consensys for strategic support. Q2 revenue was $0.7 million, with a net loss of $103.4 million, largely from non-cash stock compensation and a $87.8 million impairment on staked ETH.

USELESS Memecoin Gets Binance Futures Listing After Coinbase and Binance US

Binance Futures will list the USELESSUSDT perpetual contract on August 15 at 20:15 (UTC+8), offering up to 50x leverage. This listing follows recent announcements from Coinbase and Binance US, which have already boosted USELESS’s visibility and trading volume.

As the largest memecoin by market cap launched on Bonkfun, USELESS has quickly attracted attention in the crypto community. With multiple major exchange listings in such a short time, USELESS is cementing its presence as a leading solana memecoin in the current market.

$6 Billion in BTC & ETH Options Expire on August 15

On August 15, $6 billion worth of crypto options expired, representing about 9% of total open interest. For Bitcoin, 39,000 options expired with a Put/Call Ratio of 0.95, a Max Pain at $118,000, and a notional value of $4.6 billion. Ethereum saw 280,000 options expire, with a Put/Call Ratio of 1.04, a Max Pain at $4,000, and a notional value of $1.3 billion.

BTC recently hit a new high, while ETH reached an all-time high near $4,800, with market sentiment extremely optimistic. Deribit set a milestone this week, processing $10.9 billion in options trading in a single day, its first after acquisition. BTC’s implied volatility remains low, under 35% for short- and medium-term options, while ETH’s main-term IV sits near 70%.

OKX Executes Massive OKB Burn, Supply Now Capped at 21 Million

According to Etherscan data, OKX’s official buy-back and burn wallet permanently removed 279 million OKB tokens from circulation today at 14:00 (UTC+8). The tokens were sent to the blockchain’s null address (0x00…0000), marking a verifiable on-chain burn. This move reduces the total OKB supply to just 21 million tokens, aligning it with Bitcoin’s capped model and potentially increasing scarcity for holders.

The post Latest Crypto News, August 15 – Why Is Crypto Down Today? U.S. July PPI Surges, Triggers Crypto Market Sell-Off: Best Crypto To Buy During This Dip? appeared first on 99Bitcoins.