The crypto landscape today is a bit of a mess. Established coins like Bitcoin (BTC) and Ethereum (ETH) are down and don’t seem to be able to stem the losses.

In the last 24 hours,

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

1.01%

Bitcoin

BTC

Price

$85,670.98

1.01% /24h

Volume in 24h

$36.84B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

dropped to $83,540 before changing course and breaching the $84,000 level, and then finally retesting the $85,000 level, where it is trading at the moment. It is, however, still down by 11% on the weekly charts.

For the most part, it seems like a weak job market, coupled with the dovish comments by New York Fed President John Williams, has encouraged buying at lower levels.

$BTC break those two notable near term resistance marks, and we can see up to $93k…

Mush bulls. pic.twitter.com/FmgW2ddn3i

— Heisenberg (@Mr_Derivatives) November 23, 2025

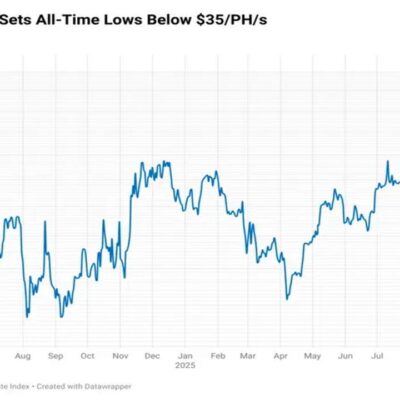

Meanwhile, the Fed rate cut probability has jumped to more than 70% as opposed to nearly 40% just a few days ago, prompting traders to rotate into riskier assets such as crypto.

(Source: FedWatch)

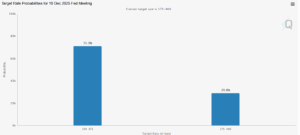

However, a look at US BTC spot ETFs puts data into perspective. Per SoSoValue’s data, US BTC spot ETFs have lost more than $3 billion during the past month, with weekly outflows amounting to around $1.5 billion. The only bright side is that the daily inflow is still positive at $238 million, a drop in a bucket.

(Source: SoSoValue)

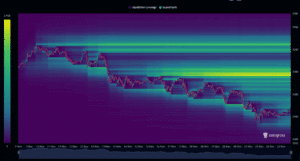

At the moment, BTC is trading below its 20-day and 50-day EMAs. For BTC to reverse its price action, it needs to recapture both these EMAs at $86,281 and $90,322 before it can retest its 100-day EMA at $95,075, which incidentally also forms the upper resistance level.

(Source: TradingView)

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

ETH Crypto Consolidates Above $2.7k, Retests $2.8k Level Today

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

0.39%

Ethereum

ETH

Price

$2,799.23

0.39% /24h

Volume in 24h

$14.96B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

has been experiencing difficulties over the past few days. For the longest time, it had managed to hold its own above the $3,100 level. Alas, it was not to be. Although ETH followed BTC during the broader market pullback, its decline was subdued and not as dramatic.

Its price action took a decisive plunge and broke through the $3,000 support level before subsequently breaching more support zones, dropping to $2,680 before finally stabilizing above $2,700 level, where it had been consolidating since the last couple of days.

For ETH to start ascending again, it must hold above $2,800. It is currently on its way to retest its 20-day EMA at $2,823. However, the critical level to capture is the 50-day EMA near $3,000, which is also the resistance level to beat.

(Source: TradingView)

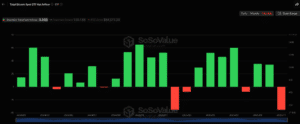

Analysing on-chain data reveals heavy liquidation clusters surrounding its price action between $3,100 and $3,600, acting like major resistance zones.

(Source: CoinGlass)

At the same time, online sleuths think that now is a good time to get in on the action and buy the dip before the price flips again. Its Fusaka upgrade is slated for December, and with prices as low as they are, it might be good to go long.

#ETH: Big potential. Buy the dip.

Big upgrade coming (last one pumped price 50%). Correction is local, not expecting a big drop.

$2600-$2700 possible bottom, otherwise trend breaks. Most weak hands are out. Good time to buy.

Expecting new ATH, targeting $5K for profit taking. pic.twitter.com/zei8mEBCZu

— Matt Wraith | AI & Dev (@MattWraithSOL) November 23, 2025

However, it all depends on ETH maintaining the $2,700 level. Sliding down from $2,700 will test lower support zones near $2,300-$2,400.

EXPLORE: Top 20 Crypto to Buy in 2025

Institutions Are Buying The ETH Dip

Retail is crying in a corner, whereas institutions are buying the dip, hoovering up as many coins as they possibly can till the downturn lasts.

Bimine, for instance, scooped up 21,537 $ETH ($59.17 M) from FalconX

Tom Lee(@fundstrat)'s #Bitmine is still buying $ETH.

A new wallet 0x5664 — likely linked to #Bitmine — just received 21,537 $ETH($59.17M) from the #FalconX 8 hours ago.https://t.co/8kg77vYddh pic.twitter.com/FKivNNe0jM

— Lookonchain (@lookonchain) November 23, 2025

Although a huge number, X Hawks pointed out that it is only 0.018% of the entire supply.

21,537 ETH sounds massive…

until you realize it’s just 0.018% of the entire supply.Tiny buy on a giant ocean.

— Rekt Specter (@rektspecter) November 23, 2025

Crypto ATM Operator Eyes $100M Sale After Founder’s Money Laundering Charges

Crypto ATM operators, Crypto Dispensers, are thinking about selling off their business for around $100 million, and the timing of this decision is raising eyebrows across the cryptosphere.

Just a few days earlier, the company’s founder and CEO, Firas Isa, was charged by the US Department of Justice (DOJ) with one count of conspiracy to commit money laundering to the tune of $10 million.

NEW:

Chicago's Crypto Dispensers, fresh from money laundering heat, eyes a $100M exit. Talk about flipping the script from legal woes to major cash out.

Source: https://t.co/XdyndyTVAv

— Web Weavers

(@WebWeaversHub) November 22, 2025

Crypto Dispensers didn’t mention any of the legal drama as part of its decision to sell off its business.

It did, however, point to bigger issues such as rising fraud, tougher regulations, and the fact that people don’t really use these machines more than once or twice.

Chainlink Core Infra For Tokenized Finance: Grayscale

Grayscale has chalked up Chainlink as indispensable for tokenized finance, arguing that its decentralized oracle network is unchallenged when it comes to connecting real-world data to blockchain systems.

According to Grayscale’s new research, with more and more traditional assets like stocks, bonds, and real estate moving to tokenization, reliable data feeds from Chainlink become even more important.

Grayscale research team members are suddenly retweeting @ChainLinkGod. Today they shared one of the best recent research papers on $LINK, basically calling it the best investment tied to the rise of tokenized finance.

This is not random. The clock is currently running toward… pic.twitter.com/ZlpAEaI5dV

— Moeskul (@Xmarine777) November 20, 2025

Chainlink has, over the years, slowly become a part of the plumbing for institutions such as SWIFT, DTCC, and ANZ Bank for proof‑of‑reserves, moving assets across chains, and automating settlements.

The post What’s Happening In Crypto Today: BTC Retests $85k, ETH Consolidates Above $2.7k appeared first on 99Bitcoins.